Read Time

8 min

Photos by Brooke Olsen for HNGRY

Last Friday, HNGRY hosted 70 food industry innovators for a day-long summit focused on the increasingly blurring lines between restaurants, CPG, and the broader supply chain through fireside chats, breakout sessions, and networking breaks. Unlike traditional conferences, the goal was to facilitate a day of collaboration and connection amongst an interdisciplinary group of investors, operators, and startup founders working in both traditional and tech-forward businesses. Keynotes were focused on restaurant loyalty, food accessibility and nutrition, regenerative agriculture, and omnichannel restaurant and CPG brands. Over the course of the nine-hour day, we held five breakout sessions on food-as-medicine, foodservice automation, food waste management, content x commerce, and of course, the potential of ghost kitchens. Perhaps the most rewarding part was watching restaurant operators and CPG brand founders debate tech folks on their perspectives. Below is a summary of the day’s events organized into three key themes I pulled out across the keynotes.

The critical role of economic incentives and policy on our food system

One of the major takeaways I had coming out of the day was the underlooked importance of government policy, notably the Farm Bill, on how our food is grown, sold, and purchased by consumers. These incentives inevitably create second-order effects that have drastically impacted the health of our population and our planet.

Anytime Spritz is creating the first regenerative organic spirits and RTD cocktail brand focused on bringing transparency to the opaque $250bn alcohol industry in the US, only 1% of which is made with organic ingredients. Because the industry is governed by 100-year-old laws under the Alcohol and Tobacco Tax and Trade Bureau, producers aren’t required to disclose the ingredients of their products. Co-Founder Maddy Rotman explained her bewilderment around not knowing what’s inside of various alcoholic beverages and the battle she fought against the bureau, who initially fought her decision to include Anytime’s ingredients on its packaging.

Rotman, who previously led sustainability efforts for online grocers like FreshDirect and Imperfect Foods, thinks the alcohol industry can be a beacon of change for our industrialized agricultural industry thanks to its growing trend of premiumization. Whereas the USDA incentivizes farmers to grow commodity crops like corn, soy, and wheat that ultimately ends up on the shelf as cheap, processed food, Rotman sees a future where financial incentives around regenerative agriculture can bolster social equity alongside the health of soil and animals.

“Wheat is the third largest crop after corn and soy,” she said. “Imagine if we transitioned all of that land to regenerative and put it into spirits at higher values for the growers and it tastes damn good.”

Similarly, Everytable Co-Founder & CEO Sam Polk explained how government incentives through SNAP and EBT have led to unhealthy outcomes. Last year, the government spent ~$120bn on SNAP entitlements for groceries but because the program excludes pre-prepared hot food, Polk believes that most of those dollars get spent on shelf-stable, ultra-processed foods that are easier to prepare. On the other hand, EBT subsidies, which are allocated towards restaurant meals, only reimburse lower-cost foods that are only found at fast food chains.

“If you make it in a factory, you can centralize production, [and] get massive economies of scale, massive efficiencies, automation, etc. If it's non-perishable, it becomes this great product that you can send all over the world over any time period and it can sit on a retailer's shelf forever or for at least six months,” said Polk. “The reason that all works is because you know, it's a better business. We just didn't understand at the time that that better business was, frankly, fatal to humans on some level.”

Everytable was born in response to the incentives that led to the 70% of food in the US that is considered ultra-processed. By coupling centralized production with tight logistics and perishable vs. non-perishable food, the company is making an argument that consumers shouldn’t have to make a tradeoff between nutrition and price when it comes to eating out. It sells meals in underserved markets for $6-8 and $7-10 in more affluent ones across New York and Southern California.

Turning restaurants into D2C, omnichannel brands

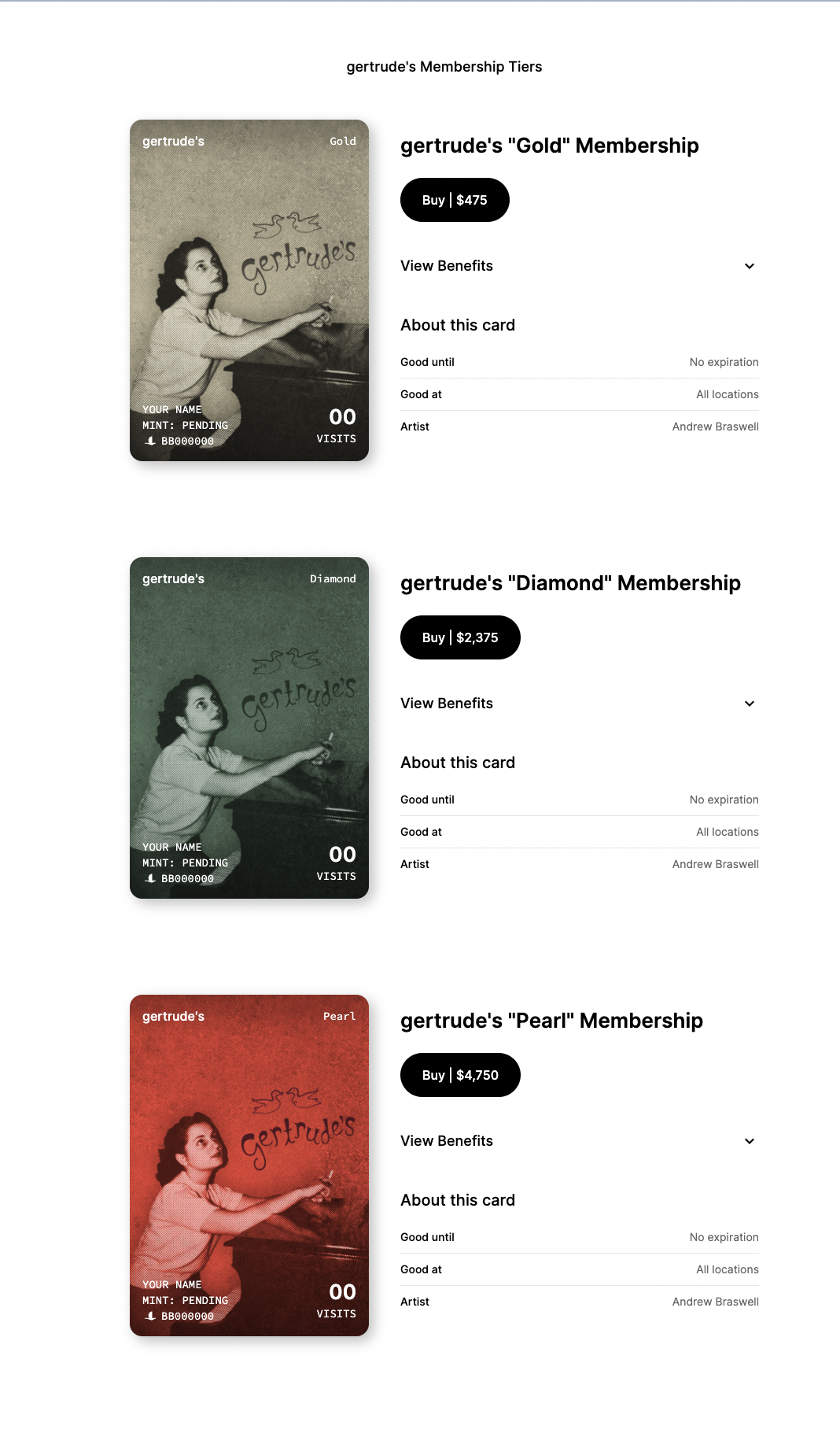

Earlier this month, Resy and Eater co-founder Ben Leventhal announced a $24mm Series A for his latest startup Blackbird Labs, which seeks to help independent restaurants build direct relationships with their customers. In our fireside chat, Leventhal called out the existential problem facing restaurants when it comes to the power dynamics between them and large gatekeepers like POS and marketplace companies.

“If you think of the restaurant industry as an economy, it’s almost a trillion dollars, but the restaurants are net importers, buying more than they’re selling,” he explained. “Restaurants have created the brand, a product that people are obsessed with, but somehow they’re finding that they have to keep buying their customers back.”

Over the last two decades, Leventhal has focused on building tools to improve what he calls “restaurant connectivity”– first through media with Eater, and then through first-party reservations and table management with Resy. In his third chapter, he is reaching deeper to help restaurants reimagine the experience inside and outside their four walls through new tools geared at improving guest acquisition and retention.

The key innovation behind Blackbird is what Leventhal describes as a “coalition loyalty platform.” Just as airlines and credit card companies have partnered to incentivize consumer purchasing behavior over the past few decades, restaurants have become the next use case ripe for such large-scale loyalty. The problem with existing programs is that they are either heavily siloed like Starbucks and Sweetgreen or lack enough utility, as we’ve seen through gatekeepers like Square and Toast. Thus, Blackbird’s native $FLY token is creating a new currency whose incentives are tightly aligned between restaurants, consumers, and its tech platform while remaining interoperable between merchants. This unlocks a utility flywheel where restaurants join the platform and offer rewards for various guest interactions, customers share data and visit merchants, and third-parties start to take notice and get involved. What the last part looks like is anyone’s guess, but think along the lines of partnerships between Blackbird and networks ranging from as large as American Express to web3 DAO’s (Decentralized Autonomous Organization) like Friends With Benefits. Such partnerships will seek to bring Blackbird’s restaurant network to other restaurant-obsessed audiences, further growing the pie.

Beyond retention and acquisition, Blackbird has already helped restaurants improve their profitability through the sale of memberships that serve as early crowdfunding campaigns during new concepts’ “friends and family” periods. Eager diners use Blackbird to purchase digital membership cards that unlock benefits like restaurant previews as well as perks like priority reservation lines once the restaurant is fully opened. Leventhal sees such interactions expanding to new business lines like pasta sauces, fashion drops, and much more.

Similar omnichannel strategies were discussed during my conversation with DOM Food Group’s Nathan Tan, who delved into the nitty gritty of its incubated brands like goop Kitchen, Cravings by Chrissy Teigen, and Táche. DOM has a team of a dozen domain experts ranging from culinary in foodservice to CPG and retail thinking about the convergence of restaurant and grocery. Tan said that it was a foregone conclusion that modern brands should be omnichannel as grocery stores look more like restaurants and vice versa, citing a potential example of goop Kitchen leveraging its R&D in dressings to launch in grocery stores. Other brands like Táche pistachio milk are taking the Oatly playbook and launching on the menu of cafés while carefully scaling distribution on grocery shelves. According to Tan, it’s not a matter of grocery or restaurant, but rather sequencing of the two.

The new rules of customer acquisition and fulfillment

By and large, every speaker acknowledged that the era of online customer acquisition arbitrages are over, requiring new strategies. In many cases, this has led brands like Anytime Spritz to go old school, doubling down on retail partners like Total Wine & Spirits and sampling. Anytime’s Rotman explained how the minimum order sizes don’t work to ship alcohol online, let alone most CPG food brands, and how offline taste tests can convert far more customers faster and cheaper than any Instagram ad.

“Going back to business economics driving everything, the biggest problem in my view was that if you ship something in the mail, and you have to package it and keep it cold, that's gonna cost you basically at least $20,” said Everytable’s Polk. “So either through margin on the meals that you sell, or the delivery cost you charge, you've got to make back that $20 plus a profit. That puts you as a company in a position where you have to get a lot of revenue per order, which is in direct contradiction to how often people want to eat meals from the same place.”

Everytable has recently switched from a centralized fulfillment model from its commissaries to a hub-and-spoke one that allows customers to order on-demand. This also unlocks lower minimum order sizes, which provide more flexibility than legacy ship-to-home meal solutions like Factor and Freshly. Furthermore, because Everytable has built a centralized hub-and-spoke system that only requires a single employee working in a store without any kitchen, each of its locations can survive on below-average sales volumes. Not only do these stores fulfill delivery orders for customers and external retail partners, but they also serve as valuable marketing billboards for its online delivery service.

For DOM Food Group, partnering with Gwynneth Paltrow on goop Kitchen has given the ghost kitchen concept a monthly audience of ~30mm people on social media, all of which is entirely earned (read: unpaid). Unlike other failed celebrity-backed virtual concepts, goop Kitchen benefits from Paltrow’s inherent credibility in food over the past 15 years. Combining the low-cost structure of ghost kitchens with goop’s audience has unlocked a winning model in the virtual brand space that has seen some of its store-level sales approaching that of Chick-fil-A. However, like most virtual brands, goop is still mostly reliant on third-party marketplaces for its sales. It has addressed this challenge by offering larger default dressing portions (due to lack of communication options), oversaucing its pastas for longer fulfillment times, and building its own guest experience team that can triage order issues.

In conclusion…

The conversations surrounding both HNGRY Summit’s structured keynotes and unstructured breakouts demonstrated the need for multi-disciplinary programming that taps into the collective wisdom of players across the entire food ecosystem. As I mentioned in my introduction speech, we are at a critical juncture within this massive industry where the choices we make now will influence our quality of life over the coming decades. Such pivotal decision points require the presence of many stakeholders at the table, and while we were just a group of 70, we must recognize that change starts small. I’m proud to say that the event was a big success and I intend to follow up with year 2 to bring more minds together for another day of conversation, collaboration, and connection.