Accidental Ghost Kitchens Pervade As Restaurants Struggle To Reopen

June 18, 2020

Read Time

5 min

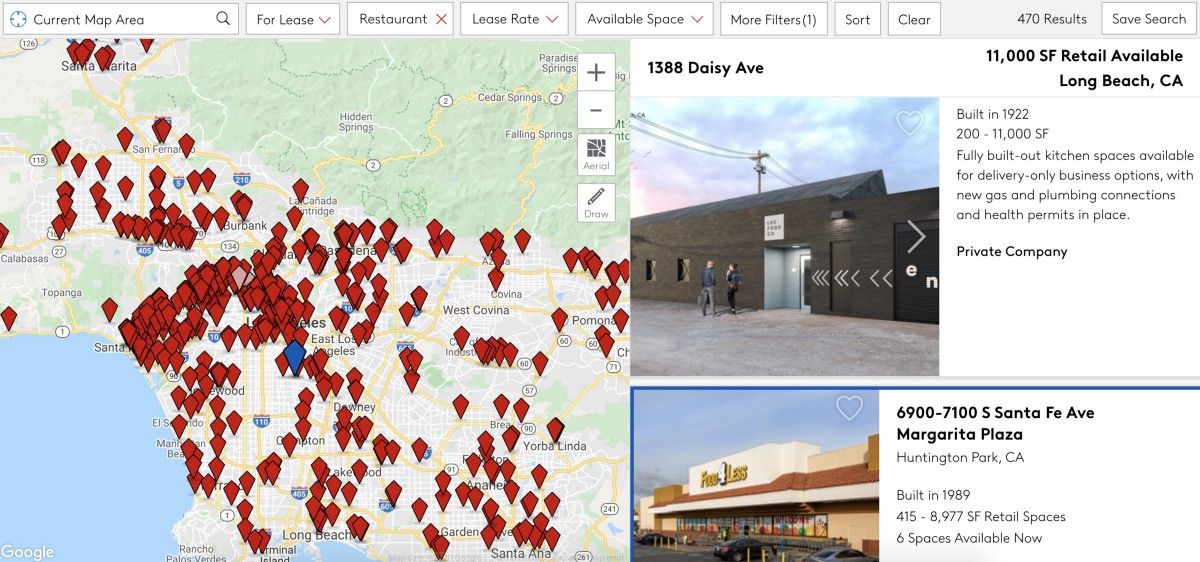

As it aspires to dominate the future of restaurant delivery, CloudKitchens is pursuing two parallel strategies. On the one hand, it’s converting distressed properties into 30 subdivided kitchen spaces. I’ll refer to this as their bread-and-butter “asset-heavy” model that has recently become the subject of suspected arson in SF. On the other, it’s enticing independent restaurateurs and food trucks across the country to use its software to become mini ghost kitchens that sell a handful of its delivery-optimized brands. I’ll call this “asset-light.”

As vacancies grow and restaurants double down on delivery within their existing four walls, the latter model has become increasingly favorable. According to a prospective nationwide tenant, both Kitchen United and CloudKitchens have reduced pricing for their spaces down by as much as ~40% last month.

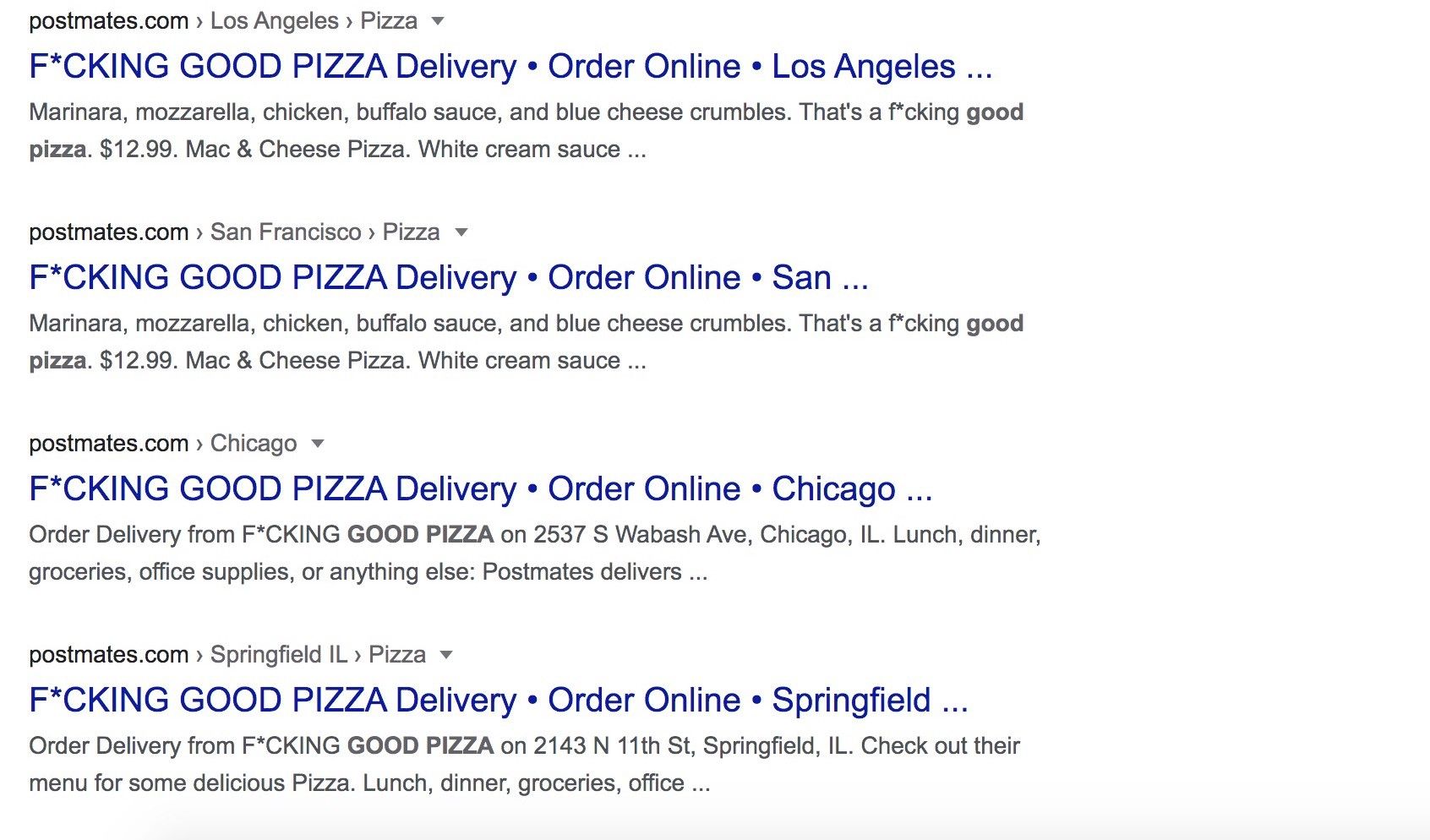

Meanwhile, CloudKitchens’ sales team has been aggressively approaching restaurants in cities like LA, Austin, Chicago, New York, and Houston under the guise as delivery consultants using the “FutureFoods” moniker. The service, which promises to “sky rocket your restaurant’s delivery sales”, sends free tablets containing its proprietary Otter software and a handful of brands. The company claims it can generate $1,500-$3,000 a week in incremental top line sales for restaurants at a $28 average order value. Depending on the establishment’s cuisine, “FutureFoods” can license any one of its 28+ in-house concepts without lifting a finger in exchange for a 10% commission on top of the traditional 30% delivery fee. These concepts include “Thick Chick” fried chicken sandwiches, “Dolce & GaPasta” pasta dishes, and “Grannies Pannies” pancakes. Home Sweet Harlem in New York has served ten “FutureFoods” brands in addition to its original menu. The model is fairly similar to UberEats’ virtual restaurant program, which has helped its existing portfolio of restaurants create thousands of ancillary delivery brands since 2017.

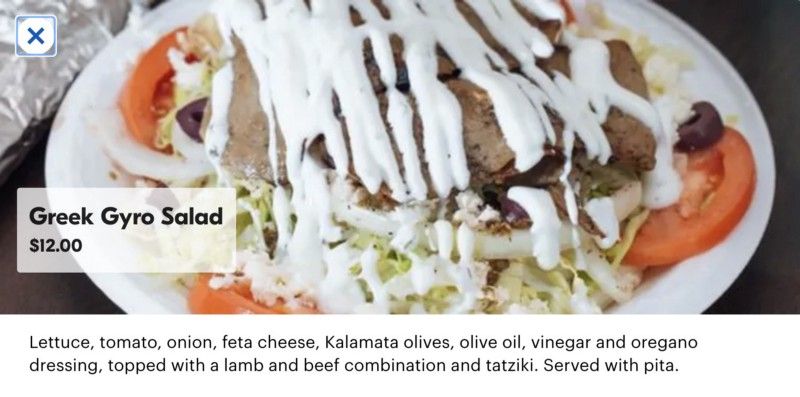

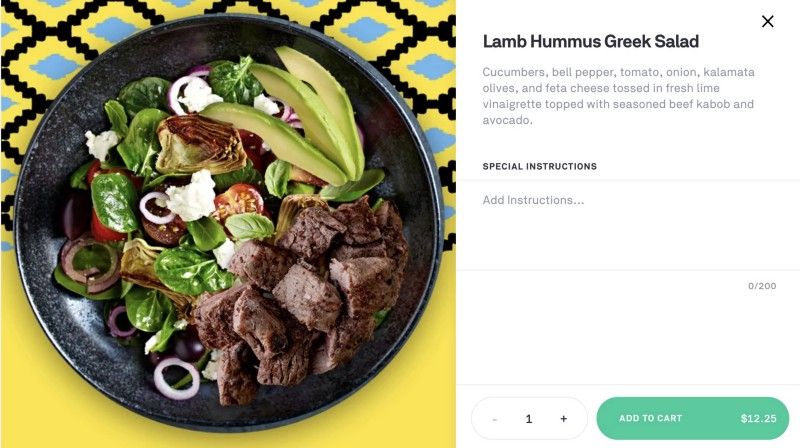

On many occasions, “FutureFoods” has craftily targeted restaurants located in areas near its under-construction warehouse kitchens with the presumed goal of testing which tenants might succeed once complete. This would arm the company with valuable data that may de-risk a particular concept, improving retention, and thus increasing the value of its real estate. Many restaurants are pizzerias, gyro shops, or large-format American eateries that can just as easily prepare “Killer Wings” as they can an “Eggwich” using their existing ingredients. After all, they had already shuttered their dine-in and become accidental ghost kitchens overnight due to nationwide lockdowns. In my conversations with some of these restaurateurs that had bit the “FutureFoods” bait, many seemed confused by what they actually signed up for and what the brands actually represented.

“I don’t understand the program all that much,” said Amin Bitar, a 27-year veteran owner of Bitar’s, a family-run Lebanese restaurant that has become a South Philadelphia staple. “I don’t know what the connection is between these menus that they want me to produce and FutureFoods. It’s like them going to some place in California and asking them if they want to sell Bitar’s… I don’t know the legality of it and there’s a lot to be figured out.”

Bitar said he turned on the Otter tablet by accident and had to shut it off after instantly being bombarded with dozens of orders. Since then, he hasn’t been able to get his delivery business up and running.

“The technology is out of sync, they haven’t set me up properly,” he explained. “Otter is all over the place, I’ve dealt with a bunch of technical people. It’s a bunch of kids.”

As a Lebanese grill, FutureFoods set Bitar’s up with concepts like Taqueria Medeterranea, Holy Hummus, Bob’s Kabobs, Saint Pita, Keto Kabobs, and Beverly Hills Platters which are templated permutations of the same dishes and ingredients. All the photography and branding is provided by “FutureFoods” without much oversight to ensure that customers actually get the dishes as advertised.

In some cases, the company has undercut the restaurant’s menu price. For example, the very same chicken parmesan at Trattoria Ornella in Astoria, NY that normally sells for $18 is offered under Future Foods’ “Big Italy” concept for $12.95.

“Here’s my paranoia,” expressed Bitar. “You’ve read articles where restaurants who don’t want to do business with Grubhub are listed there. This is way too much for me.”

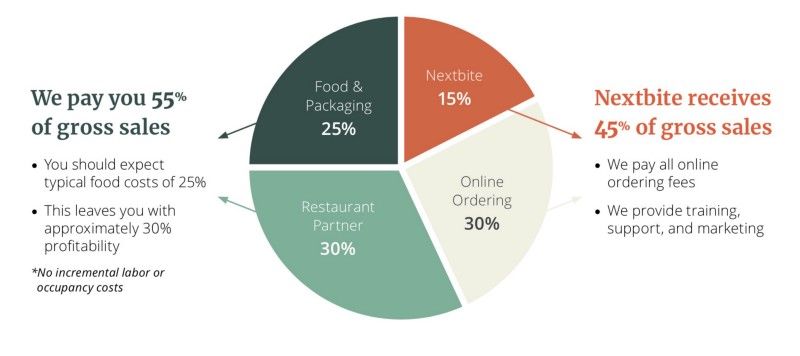

Ordermark, an Otter competitor with $30.7mm in funding, offers similar virtual franchising opportunities through Nextbite. The company pays out 55% of gross sales to a restaurant and handles all the ordering fees with platforms, keeping a 15% commission for itself. In its marketing materials, Nextbite explains that a typical restaurant partner could make an additional 30% profit on an order assuming 25% food and packaging costs. Its brands are Grilled Cheese Society, Monster Mac, Mother Clucker, Outlaw Burger, and Ghost Grille. There are more brands underway such as Atomic Wingz, Empire Bistro, and Jenny’s Biscuit.

A November Popula piece from M.L. Schepps titled “Hell’s Kitchens,” paints a dystopian picture of the world of virtual brands where algorithms increasingly shape our eating habits:

“The consumer who does not leave home, who never decides on a whim to try out the jollof rice or the machaca burrito, who simply defaults to a burger, who is given the option to “choose” between two different brands serving identical food prepared identically, is the modern capitalist ideal. They can have any food they want, as long as it comes from the same kitchen; see any film they want, as long as it is produced and distributed by Disney; read anything they want, as long as it arrives via the algorithms of Facebook or Google.”

Welcome to the world of asset-light, search-optimized food delivery. Please come again.